In Texas, individuals facing financial challenges post-bankruptcy can consider a Texas title loan after bankruptcy as a quick cash solution, using their vehicle's title as collateral. While these loans offer faster approval times and flexible repayment plans, they carry risks like potential vehicle repossession upon default. Understanding state bankruptcy laws and choosing a reputable lender is crucial to make informed financial decisions when exploring this option.

“Texas residents facing financial challenges post-bankruptcy may wonder about their borrowing options. This comprehensive guide explores the intricacies of Texas title loans as a potential source of funding. We delve into the interplay between state laws and bankruptcy regulations, ensuring borrowers make informed decisions. Understanding eligibility criteria, benefits, risks, and repayment flexibility is key to navigating this alternative financing option. By exploring these aspects, individuals can determine if a Texas title loan after bankruptcy aligns with their financial goals.”

- Understanding Texas Title Loans and Bankruptcy Laws

- Eligibility Criteria for a Texas Title Loan After Bankruptcy

- Benefits, Risks, and Repayment Options to Consider

Understanding Texas Title Loans and Bankruptcy Laws

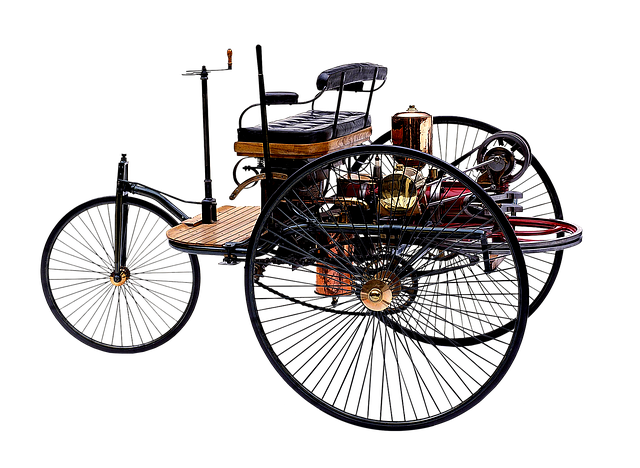

In Texas, a title loan is a type of secured lending where a borrower uses their vehicle’s title as collateral to secure a loan. This option is often considered for those in need of quick cash, especially during challenging financial times. However, understanding the interplay between these loans and bankruptcy laws is crucial. Texas has its own set of rules regarding bankruptcy and debt relief, which can impact an individual’s ability to borrow through a title loan after filing for bankruptcy.

Bankruptcy provides a legal framework for individuals to manage their debts, offering a fresh start. Yet, it doesn’t necessarily erase all financial obligations. The Title Loan Process may still be accessible for those who have completed their bankruptcy proceedings, but it requires careful consideration of one’s current financial situation and future prospects. Unlike other loan types, such as Semi Truck Loans, title loans have specific requirements and potential consequences, especially if the borrower defaults on repayments, as they risk losing ownership of their vehicle.

Eligibility Criteria for a Texas Title Loan After Bankruptcy

After experiencing bankruptcy, rebuilding your financial health can feel like a daunting task. Fortunately, Texas offers an alternative lending option with its title loans. These short-term, high-interest loans use your vehicle’s title as collateral, allowing you to access funds quickly. However, eligibility is crucial for a smooth borrowing experience.

To be considered for a Texas title loan after bankruptcy, lenders typically require that borrowers meet certain criteria. Firstly, the borrower must own their vehicle outright, with no outstanding loans or leases. This ensures the lender has clear title to the asset. Additionally, a stable source of income and a valid driver’s license are essential. Lenders often assess your credit history, but unlike traditional loans, prior bankruptcy may not automatically disqualify you. Keep in mind that keeping your vehicle during the loan period is a significant advantage, ensuring you retain possession while repaying the loan.

Benefits, Risks, and Repayment Options to Consider

After experiencing bankruptcy, securing a loan can seem like an insurmountable task. However, Texas title loans after bankruptcy offer a unique opportunity for individuals seeking quick cash. These loans utilize the equity in your vehicle as collateral, providing access to funds without the stringent credit checks and approval processes often associated with traditional banking options. This alternative financing source is particularly appealing for those who have faced financial setbacks but are on the path to rebuilding their credit.

While Texas title loans can be a lifeline in dire circumstances, it’s crucial to understand both the benefits and risks involved. The primary advantage lies in their accessibility; they offer a faster turnaround time compared to other loan types. Additionally, flexible payment plans allow borrowers to repay at their own pace, making them more manageable for individuals with variable income streams. However, the main drawback is the potential risk of default, as failure to meet repayment terms can result in repossession of your vehicle. It’s essential to thoroughly review loan requirements, including interest rates, and choose a reputable lender that provides transparent payment options to ensure the best possible outcome when pursuing a Texas title loan after bankruptcy.

If you’re in Texas and looking for financial support after bankruptcy, understanding your options is crucial. A Texas title loan can provide a quick solution, but it’s essential to weigh the benefits and risks before borrowing. By familiarizing yourself with the eligibility criteria and repayment methods, you can make an informed decision that best suits your post-bankruptcy financial needs. Remember, while a title loan may offer immediate relief, responsible borrowing is key to avoiding future financial setbacks.